Table of Contents

Financial Leasing

Financial leasing is a financing instrument that allows a tenant to use a certain asset while it pays a series of rentals or installments. After a period of time, the tenant has the option to acquire ownership of the asset in question, by paying a prearranged additional amount.

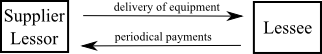

A financial lease is a contract between 2 parties:

- Lessor: Grants the use of a good, like a machine, to the other party.

- Tenant or Lessee: Pays a periodical amount to the lessor.

During the lease, the tenant can use the asset but will not have legal ownership of it. The lessor (a finance company or a manufacturer of goods) will be the legal owner of the good during the duration of the lease.

After a period of time, the tenant has 2 options:

- Purchase the good, paying an additional amount that is lower than the price of the good in the market. This amount has been prearranged in the leasing contract.

- Give the good back to the lessor.

Usually, there is a third option, to extend the lease period. The lease period is usually between 1 and 5 years.

Advantages

Some advantages of the financial lease include:

- The assets can generate revenue that can be used to pay for it's use and eventual ownership.

- A lease debt doesn't have to be considered a liability: it can have no impact on credit availability.

- The lease rate is fixed, it is not a source of volatility.

- If, after the lease period, new technology make new equipment available, the lessee can upgrade by giving the old equipment back and leasing a new one.

- Business can use industrial equipment without the need to make large upfront cash payment. There is less need for external sources of cash.

- If the business situation changes, there is less risk involved, because the lessee can give the asset back to the lessor. No resale risk.

- If, after a period of time, the lessee considers that the use of the asset is advantageous, it has the option to purchase it by paying an amount that is smaller than the market price of the asset.

Disadvantages

Some disadvantages of the financial lease may include:

- The asset leased is no equity until the lessee purchase it.

- The lessee is still responsible for maintaining the equipment, even if it's not the owner. The leesse may not know in advance the cost involved in the maintenance of the good.

- While the financing costs can be lower that the financing cost from commercial banks, there are still financing costs that do not exists when purchasing a good directly.

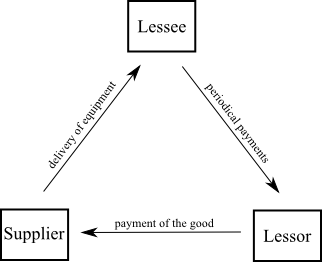

Financial institutions as lessors

Sometimes, the lessors are financial institutions (not manufacturers or providers of goods). In this case, there are 3 parties involved:

- Lessee

- Lessor

- Supplier of the good

The supplier of the good will deliver the equipment and provide information about the usage, instructions, maintenance, etc.

The lessee will pay the lessor a periodical amount of rent.

The lessor (financial institution) will pay the supplier an amount at the beginning of the lease period.

Items that are suitable for financial lease

- Heavy industrial machine (cranes, forklift, etc.)

- Vehicles (trucks, etc.)

- Medical equipment

- Restaurant equipment

- Printing equipment

- Other industrial machines: drilling equipment, lathes, etc.