This is an old revision of the document!

Table of Contents

Foreign Direct Investment

FDI is the investment of funds by people, companies of a country, in assets of another country.

There are 4 main categories of foreign direct investment:

- Creation of a new company

- Adquisition an existing company

- Reivestment of utilities

FDI entails active managemente of foreign assets, by appointing managers, establishing policies and control rules, endorsing important decisions, etc.

Foreign direct investment usually leads to technology transfer from the parent company to the subsidiary company.

FDI has been linked with corruption cases. Some companies involved in bribes are IBM, Chevron, Siemens and Total S.A..

Vertical vs Horizontal FDI

Vertical FDI: only a part of the productive chain takes place abroad.

Horizontal: the parent company engages in the same activities abroad.

Some Facts

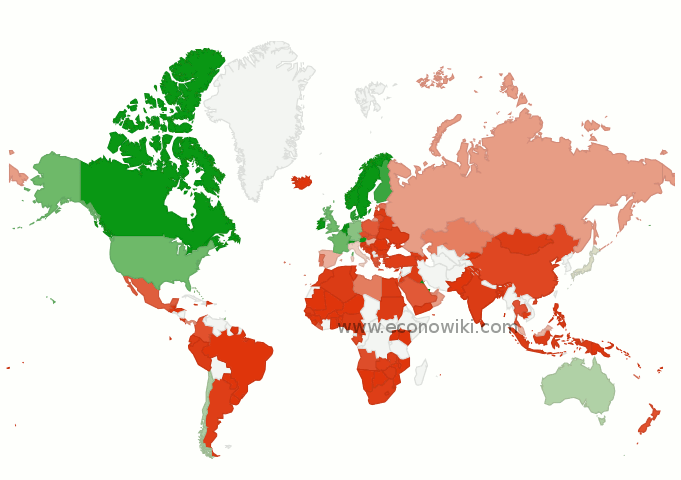

In the map we can see, in green, wich countries generated more net FDI (outflow - inflow) per capita.

The regions with more FDI per capita are Nordic Countries, Western European Countries, North America and Australia, Japan and Chile.

Discussion