This is an old revision of the document!

Table of Contents

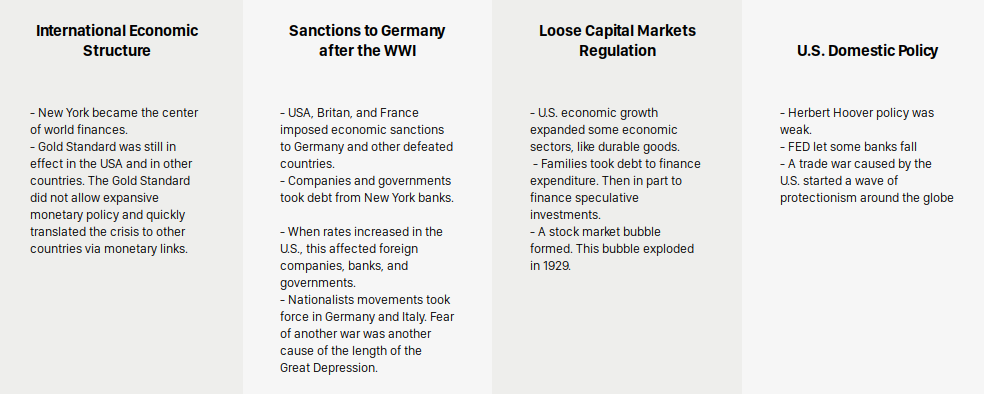

Causes of the Great Depression

- Structure of the Global Economy: Gold Standard and monetary links

- Sanctions to Germany after the WWI

- Deregulation of capital markets

- US Policy: Hoover and the FED bad policies

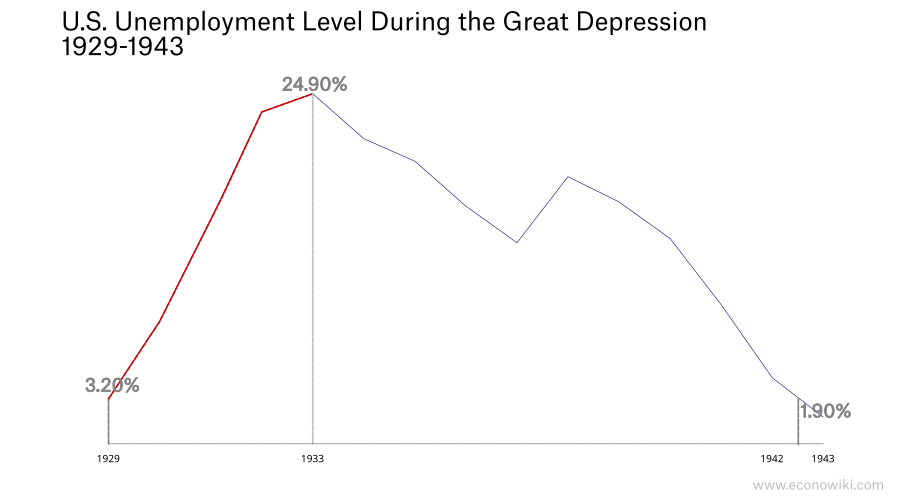

The Great Depression was the deepest economic crisis in history. Millions of people fell into poverty and unemployment, not only in the United States but around the world. Economists are still learning the lessons of the Great Depression

Cause: Structure of the Global Economy after WWI

Before WWI, London was the biggest world financial hub. London banks financed economic expansion in developing countries.

After WWI, New York emerged as the global center for world finances. U.S. banks gave loans to governments, banks, and companies from other countries, including Germany.

In many countries, Gold Standard was still in effect after WWI. Gold Standard is a monetary system where the quantity of money in circulation is in direct relation with the gold reserves of the monetary authority. The monetary authority purchases and sells gold at a fixed rate.

Gold Standard implies that there is a fixed exchange rate and countries cannot devalue its currency nor conduct an expansive monetary policy. The monetary base is a fixed relationship with the gold reserves. Research shows that countries that left the Gold Standard earlier, saw a greater reduction in the impact of the Great Depression.

Nowadays, many central banks and monetary authorities would increase the monetary base to ease pressures on the real economy. This was not possible under the Gold Standard.

Although Germany left the Gold Standard before 1929, U.S didn't. The U.S. monetary policy couldn't use one of the most important economic policy instruments.

As we will see below, when there is a fixed exchange rate, fluctuations in the interest rate do have an impact in short term capital flows and foreign monetary base. When the interest rates raised in the U.S., this had a negative impact on foreign finances and real economies.

Cause: Treaty of Versailles

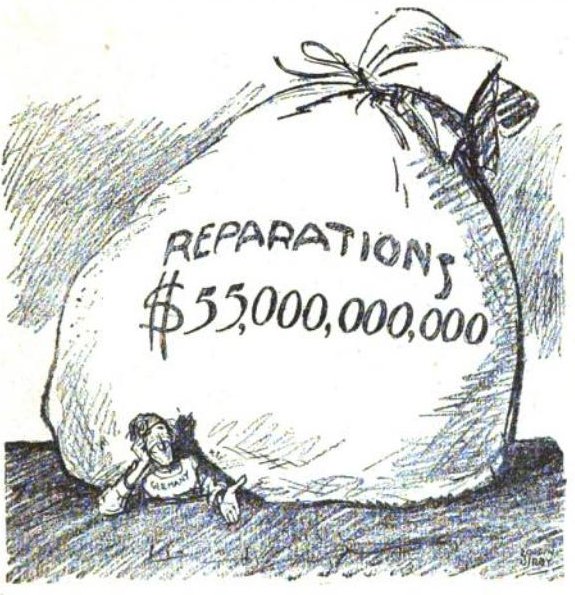

Germany was the biggest defeated country in the first world war. The U.S., England, and France were victorious. In 1929, representants of this countries gathered in Versailles, France, to sign a treaty. Italy and Japan, the other defeated countries, were also there. The Treaty of Versailles imposed large economic sanctions to the defeated, mainly to Germany.

New York World [Public domain]

New York World [Public domain]

Germany was devastated after the war and the sanctions worsened the economic situation. Keynes, an economic advisor to England, warned that the imposed sanctions would have negative consequences, not only for Germany but for Europe. History proved him right.

Germany had to pay US$33 Billions in reparations. Hitler blamed the winners for the misfortune of Germany. During the 1930s, nationalist movements started to gain traction in Germany and Italy. The fear of another was had a negative economic impact also in the U.S.

Many German companies hold debt. They were hit when the U.S. interest rate spiked, weakening the U.S. monetary system.

Cause: Economic Growth with Loose Regulation of Capital Markets

Since 1926, the U.S. experienced strong economic growth. Industries expanded quickly, particularly sectors like durable goods. Unemployment was low and there was no fear of unemployment.

Discussion